Contents

The Council of Institutional Investors reports that the Class B structure of “one vote per share” is what 90% of companies on the market go by and the CII favors this structure. There may be stipulations on the voting rights of those who hold common shares. A company can assign shares differently to indicate the level of voting privileges. Europe began trading equity on a small scale back in 1602 when the Dutch East India Company began trading company shares in Amsterdam. Soon after, the art of trading spread to the Port of London and other places. Shareholders get a percentage of earnings from capital gains.

The appeal of these large-cap stocks is that they’re supposed to be stable. People talk about stocks in a lot of different ways. There are pot stocks, blue-chips, preferred stocks, and penny stocks. You’ll find these references in guides to stock trading for beginners.

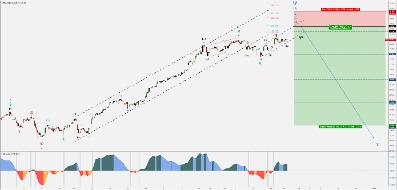

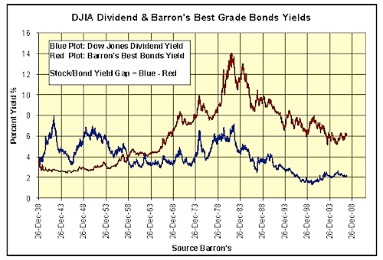

And yes, you can make money during sinking markets. An intelligent trader can make money no matter whether prices are rising or falling. Predictably, markets and underlying asset prices will generally rise amid positive news and fall when there is bad publicity. Find out how Andy Tanner uses the stock market to generate cash flow with safe, steady investing strategies – no matter what is happening in the overall economy. A mutual-fund advisory program, also known as a mutual fund wrap, is a portfolio of mutual funds selected to match a pre-set asset allocation.

Shanghai Stock Exchange

Issuing more shares will enable a business to raise more money for future endeavors. You tell your broker what stock you want to buy and how many shares you want. Market makers buy and hold shares and continually list buy-and-sell quotations for shares.

The first stock exchange in America was the Philadelphia Stock Exchange , which still exists today. An individual or entity that owns 100,000 shares of a company with one million outstanding shares would have a 10% ownership stake in it. Owning stock means that a shareholder owns a slice of the company equal to the number of shares held as a proportion of the company’s total outstanding shares. As well as risking the loss of every penny you own, having all your money in the markets is tricky if you’re suddenly hit with an unexpected expense, like repairs to your car.

That can be a great thing — if you know what you’re doing! There are a ton of opportunities to trade the hottest, fastest-moving stocks. Opportunities abound in the world of small-caps and penny stocks. It’s one thing to buy a stock with solid fundamentals. But sometimes, you buy these stocks and the price doesn’t move. You can use your trading platform to look for the biggest gainers for the past day, week, month, or year.

Copyright © 2023 Stock-Trak® All Rights Reserved. All information is provided on an “as-is” basis for informational purposes only, and is not intended for actual trading purposes or market advice. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia.

Its https://forex-trend.net/ floor is the site of every famous stock market movie scene ever. And its listings used to be even more dominant in the U.S. and the world. You’ve got buyers and sellers, and they’re making deals based on supply and demand. So you want to learn stock trading for beginners?

Stock Market Basics for Beginners

You don’t need to wait until a buyer wants your exact number of shares — a market maker will buy them right away. A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Some brokers have no minimum deposit restrictions. However, they may have other requirements and fees. Be sure to check on both of these as you look for a brokerage account that meets your stock investing needs.

Both types of funds tend to own a large number of stocks and other investments. This makes them a more diversified option than a single stock. If you’re worried about a crash, it helps to focus on the long term. When the stock market declines, it can be difficult to watch your portfolio’s value shrink in real time and do nothing about it. However, if you’re investing for the long term, doing nothing is often the best course. Mutual funds geared toward retirement — you don’t need to worry about what these words mean, or about the flashes of red or green that cross the bottom of your TV screen.

When you own a piece of a company, you benefit from its success and profit when they profit. If you choose to invest in great companies, you can experience a great return on your investments and make a great deal of money. How stock prices across the major stock indices are trending over some time is often an indication of how the economy is doing at a given time. There are a few things every investor should know before entering the stock market. When you master these basic investment terms and principles, you will be able to make smart investment decisions.

It measures how well companies are doing in terms of their share prices. This means that investors, mostly individuals, use this indicator to make decisions on whether or not they should buy or sell stocks to make a profit or loss. Meanwhile, Nasdaq is one of the largest stock markets in the world. A stock exchange is where public companies list shares of their company for purchase. There are many stock exchanges where one can purchase or sell shares in a company. Publicly traded companies are required by exchange regulatory bodies to regularly provide earnings reports.

Top traders stick to the plan and don’t let emotions take over. There are a lot of scans you can do to find potential trades. StocksToTrade comes with 40+ built-in scans, like the top percent gainer scan. If you’ve already got some potential plays on watch, you’ll be ready when they make a run. Watchlists are how you track hot sector plays, former runners, or whatever catches your eye.

Robert Kelly is managing director of XTS Energy LLC, and has more than three decades of experience as a business executive. He is a professor of economics and has raised more than $4.5 billion in investment capital. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

Investing During a Recession

Amsterdam hosted the first stock market, back in the 17th century. These indexes average or combine the values of the companies they track. When the Dow and S&P 500 were created, teams of people worked daily to keep up. The most popular indexes are the Nasdaq Composite, Standard and Poor’s 500 (S&P 500), and the Dow Jones Industrial Average . Watching them is a way of tracking the stock market.

- Even though they can offer huge returns, they can also deplete your entire life savings in a day.

- Stockbrokers, who may or may not also be acting as financial advisors, buy and sell stocks for their clients, who may be either institutional investors or individual retail investors.

- Just make sure that you define and review them periodically so that you can keep your focus on achieving them.

- These systems can match buyers and sellers far more efficiently and rapidly, resulting in significant benefits such as lower trading costs and faster trade execution.

Note that you’ll also be able to find the average volume of shares traded on a company’s website. Click on the investor relations link typically found on the homepage. So, you can usually tell by the sheer difference in outstanding shares in the SEC filings and the drastically smaller volume listed on a stock exchange site.

‘European https://topforexnews.org/es’ or ‘green-energy companies’ are the kinds of factors you might see a fund based upon. But, as this student proved, if you’re careful, it can be a successful way to profit from the markets as a novice. Stock market indices (also known as ‘indexes’) measure the performance of a particular group of companies.

Investment often depends on an individual’s tolerance for risk. Risky investors may generate most of their returns from capital gains rather than dividends. On the other hand, investors who are conservative and require income from their portfolios may opt for stocks that have a long history of paying substantial dividends. Unlike regular savings accounts, the profits you make in an ISA are always tax-free. That includes stocks and shares ISAs, which present the chance to make larger gains than a normal ISA by investing your savings in the stock market.

Use Your Stock Screener

If the stock then falls to $10 a share, the investor can then buy 100 shares to return to his broker for only $1,000, leaving him with a $1,000 profit. Throughout the 1600s, British, French, and Dutch governments provided charters to a number of companies that included East India in the name. All goods brought back from the East were transported by sea, involving risky trips often threatened by severe storms and pirates. To mitigate these risks, ship owners regularly sought out investors to proffer financing collateral for a voyage. In return, investors received a portion of the monetary returns realized if the ship made it back successfully, loaded with goods for sale. These are the earliest examples of limited liability companies , and many held together only long enough for one voyage.

Your contributions are tax deductible and your https://en.forexbrokerslist.site/ balance grows tax deferred. This is a great way to maximize your investing dollars with little effort. It can also instill in investors the discipline of regular investing. Your investment goals might include buying a house, funding your retirement, or saving for tuition. Just make sure that you define and review them periodically so that you can keep your focus on achieving them.

If the stock market could speak, it’d have some amazing stories to tell. As the company owner, you can walk away with a large amount of cash. In the past, traders would scream out orders on the trading floor.